ORIGINALLY POSTED: 23rd August 2022

This proposal is issued by the Flare Foundation and if passed consists of a set of changes that will be made to the distribution and inflation of the Flare blockchain’s native token, FLR together with changes in payout structure and recipients of the Cross Chain Incentive Pool.

Flare Improvement Proposal 01 is critically important for the long term success of Flare. Much has changed in the last two years. Flare is a radically larger project than what was originally envisioned. Instead of serving a single community with a single utility, Flare’s protocols are now on the path to provide developers with scalable smart contracts, truly decentralized price feeds, secure state acquisition from other blockchains, superior bridging for smart contract and non-smart contract assets, secured data relay and horizontal scaling through a fully interoperable multi-chain ecosystem, starting with Songbird. Flare will present developers with a single, simple, coherent stack on which to build applications that are fully cross-chain capable.

To allow Flare to thrive, the token distribution, which was designed to build participation from a single community with a single utility, needs to change such that it offers participants from any chain and new entrants to the space an equal chance to become a participant in the Flare ecosystem and help it grow.

This proposal has been designed to preserve existing airdrop recipients’ foundational place in the ecosystem and put those coming fresh to the ecosystem on equal footing. This maximizes the benefit for the most number of people within the active Flare community and ecosystem, supporting Flare’s ambition to connect the decentralized economy and drive broader adoption of Web3 in general. It can help create a more balanced playing field where all the different ecosystems which Flare will help connect would have an equal incentive to grow and participate with Flare. The proposed changes and benefits include:

- If FIP.01 is successfully passed by the community, individuals will no longer be reliant on distributions from centralized platforms. If the level of staking on Flare is anywhere near the industry average, then those who delegate will receive more Flare tokens via the new proposal than the current system.

- This proposal substantially lowers inflation and reduces the long term supply, meaning those that participate could end up with a meaningfully larger share of the token ownership as they would have more tokens with fewer in circulation.

- FIP.01 enables anyone holding FLR to delegate and receive a share of the distribution, this makes the distribution transferable, generates a strong incentive to reduce excess liquidity and treats all those who hold FLR, however they obtain it, equally.

- In some tax jurisdictions, this proposal makes it possible to defer the tax event of realizing Flare while still receiving the remainder of the token distribution, allowing better control of the timing of the tax liability.

These are just a selection of the benefits, please read the full proposal for more detail and supporting evidence. There are five sections – this introduction, the proposed changes, important voting information, rules for fairness, the rationale for the changes, and the mechanism by which they would be implemented.

The Proposal

The initial FLR distribution methodology would remain the same: The initial 15% of FLR tokens will be distributed to existing airdrop recipients. This equates to 4,278,738,205 FLR.

This proposal would then make the following modifications:

- FTSO Delegation Incentive Pool: Distribute the remaining tokens, amounting to 24,246,183,166 FLR, monthly in uniform increments, over 36 months to those that wrap their FLR tokens. (Wrapping being a proxy for delegation.)

- Reduce from the current inflation scheme of 10% per annum calculated on the total fully diluted supply of FLR, to 10% in year 1, 7% in year 2, 5% in year 3 onwards with a cap at 5bn FLR tokens per annum calculated on available supply instead of fully diluted supply.

- Cross-Chain Incentive Pool: Structure the 20Bn FLR Incentive Pool to payout the lower of either 3% per annum (calculated on available supply) or 10% of the pool per annum.

- Weight the Cross-Chain Incentive Pool payout equally to all value bridged to Flare and using Flare secured bridges.

- Weight inflation 70% to the FTSO, 20% to validators, 10% to the default State Connector set.

- Personal Delegation Account: Enable an Escrow tool that allows participants to delay realization of earnings from FTSO delegation and hence the ongoing FTSO rewards until a later date. In certain jurisdictions this will have positive tax benefits.

Voting Information

Vote timing: The vote will take place either when 66% of the initial tokens that are eligible to vote are in the hands of their intended recipients and can be used to vote. (NB. Previously we stated a deadline of 14 January 2023. Now the Token Distribution Event is occurring on 9 January 2023, this deadline no longer applies.)

Notice period: Once the vote threshold is triggered there will be a 1 week notice period followed by a 1 week period to cast the vote.

Interim Period: During the period between the Token Distribution Event and the vote, network inflation will be calculated as per this proposal (item 2) and there will be no further token distributions.

Vote metrics: The vote needs a simple majority of those who vote to pass.

Vote eligibility: The proposal may be voted on by all token holders with the exception of the Flare Foundation and Flare VC Fund (due to this entity deriving some of its token balance from the Flare Foundation).

Rules for fairness

Non-Foundation Flare related entities: All Flare related entities, including the Flare Foundation and Flare VC Fund (neither of which may vote), will have escrowed their tokens, distributing over 36 months, prior to the vote. This makes their votable tokens for this proposal equal to 15% of their intended final balance.

No Flare related entity, employee or founder may use the tokens derived from their position to earn any part of the token distribution. There are legal agreements in place, contingent on the proposal passing, with severe sanctions (giving up their entire FLR stake) to ensure that this does not happen. It is important to be clear that they may, as with any network participant, use tokens not obtained through their official position to earn part of the distribution.

Reasoning behind the proposal

This proposal is designed to achieve the following objectives:

- Improve long term token economics.

- Reward existing participants and incentivise new participants.

- Better manage liquidity.

- Improve the tokenomics for new ecosystem entrants.

- Enable the distribution of FLR to be transferable.

- Alleviate the risk of exchanges and CeFi platforms for token holders.

- Reward infrastructure providers and those that generate value for the network by enabling them to vest FLR whilst constraining inflation.

Improve long term token economics

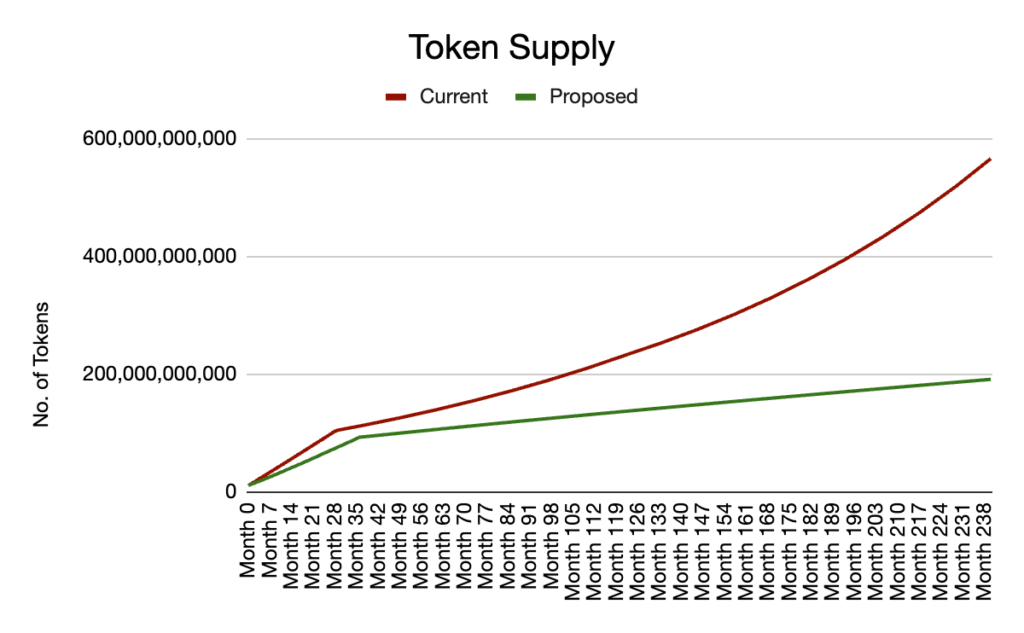

The proposal reduces short term and long term inflation by:

- Calculating the inflation rate on the lower amount of available supply instead of fully diluted supply.

- Calculating the incentive pool payout based on the lower of 10% per annum or 3% per annum on available supply.

- Capping inflation at 5Bn tokens per annum.

This reduces supply substantially relative to the existing scheme and over the long term inflation approaches zero percent.

Reward existing participants and incentivise new participants.

The proposal rewards those that participate by wrapping their FLR and delegating to an FTSO price provider. The more a recipient delegates the greater the FLR they receive.

NB: Although the FTSO Delegation Incentive Pool uses the wrapped token amount held by each address to calculate the distribution, delegation earnings increase the amount of wrapped tokens held, hence the mechanism acts as an incentive to delegate.

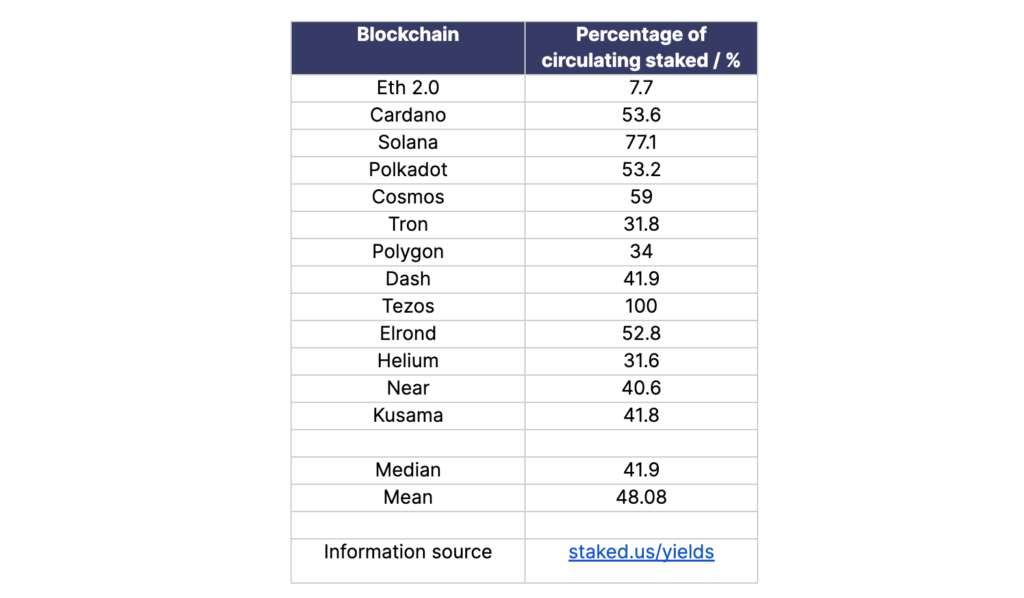

This leaves token holders with a choice between not delegating (and potentially divesting) or delegating and receiving more. Under certain circumstances this leaves existing airdrop recipients with more tokens than under the existing scheme. It should also be appreciated that it aids those that wish to exit the token do so because it attaches the potential to receive additional FLR to each token. To frame the analysis, blockchain staking rates are presented below.

The average staking rate across the industry is 48.08%. The median, which removes the effects of outliers, is 41.9%. Some scenarios comparing the current scheme to this proposal are set out below. All calculations take into account known dilutions which enable people to delegate tokens not originating from the initial distribution, such as those originating from inflation payments to validators, attestation providers, the incentive pool and Flare’s backers.

A full recap of the existing token distribution scheme and economics, with a categorized breakdown of token holdings and potential sources of dilution will be released prior to the vote, together with the same information for the proposed scheme.

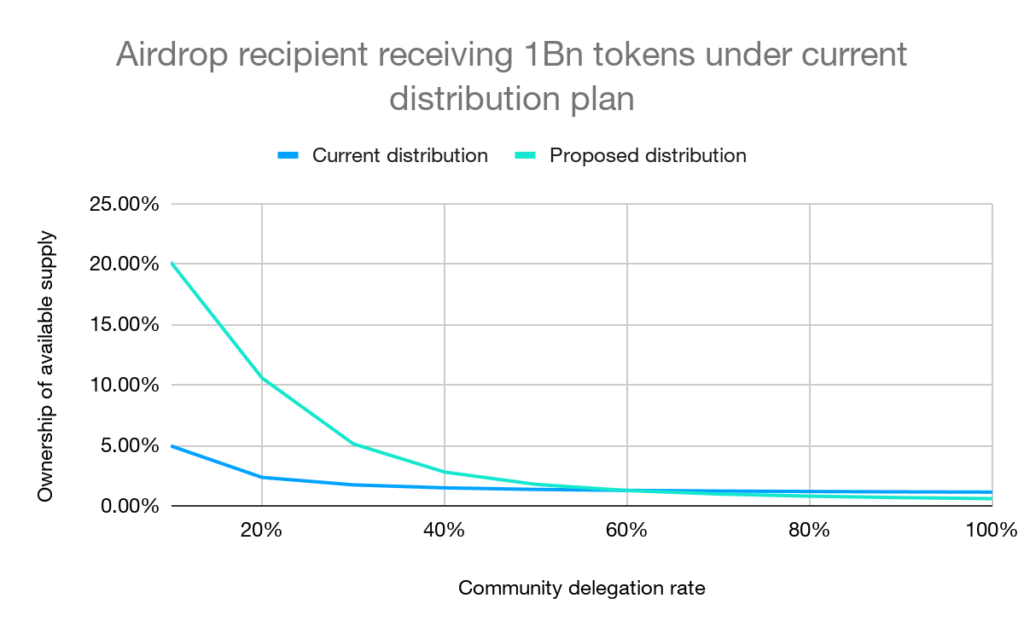

The graph above shows the percentage of FLR owned by an airdrop recipient of 1Bn tokens, at the end of the distribution period, calculated as a percentage of available supply, under both the current scheme and this proposal at different community delegation rates. The calculation assumes the recipient delegates 100% of all FLR received, for the duration of the distribution period, to an average performance data provider that charges a 20% fee. The community delegation rate is the percentage of tokens that are not owned by the recipient that are delegated. The use of 1Bn FLR as the amount received under the current plan makes the numbers simple, the same numerical relationship would pertain to any amount received.

The graph that at any community delegation rate below 60%, the delegating recipient ends up owning a larger percentage of tokens than under the current scheme. It should be noted that this delegation rate is approximately 18% higher than the industry median. Above 60% someone receiving the airdrop under the current plan would receive slightly less than they would receive under the existing scheme. The cause of this is that the FTSO treats all Flare tokens equally and hence those that receive the token from providing infrastructure or through earning from the incentive pool and other sources of liquidity will receive a portion of the airdrop upon wrapping their tokens. This is a core reason why inflation is reduced under this proposal. Ultimately treating all FLR holders equally is both fair and desirable and hence beneficial for the ecosystem overall.

Better manage liquidity.

The outset of a blockchain’s existence is the time of maximum risk for a number of key reasons:

- The ecosystem is nascent.

- The promise of the technology it offers is yet to be realized (because it needs to be built around by a decentralized community).

- The external commentariat who are vested elsewhere may wish to undermine the new ecosystem.

- The blockchain’s own community may have unrealistic expectations.

- Developers who may wish to use the technology and hence contribute to the growth of the ecosystem may be fearful that their investment of time and money into the ecosystem will not be repaid.

As the ecosystem develops, these risks dissipate and collectively the ecosystem and its participants build value together. Liquidity should develop with the development of the ecosystem, hence it is important that liquidity is well managed in the early days of the ecosystem. Excess liquidity in the early days of a new blockchain will have a strongly negative impact on ecosystem development.

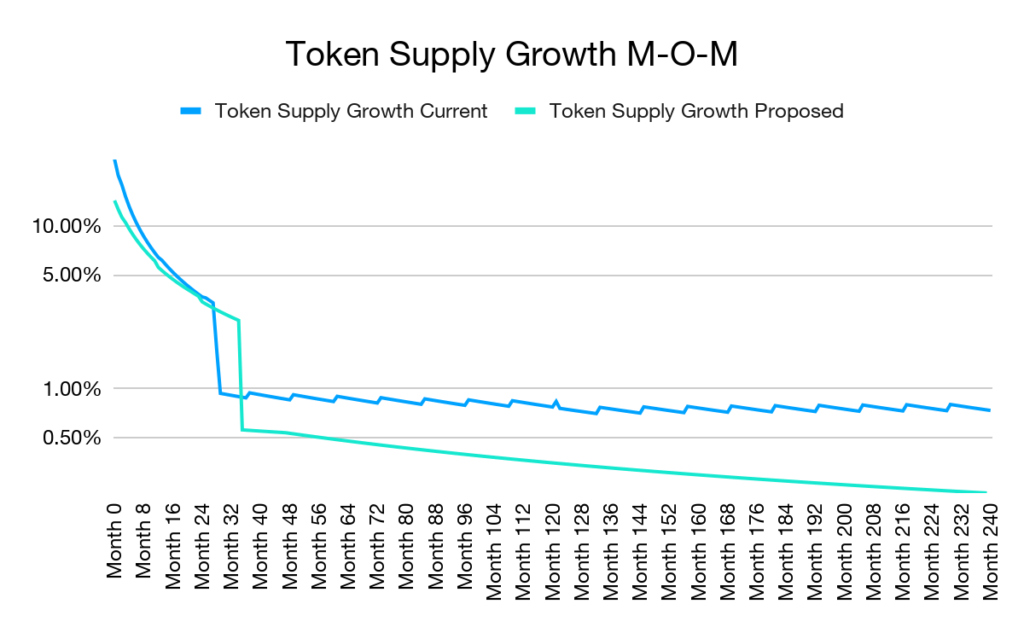

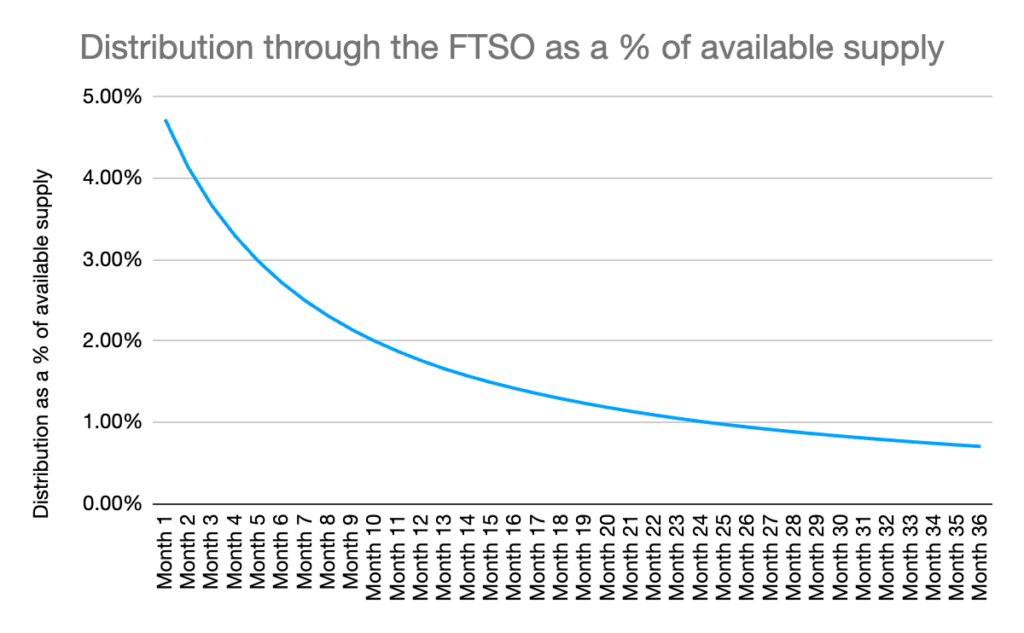

The proposed distribution method provides an additional incentivisation for network participation as the Flare ecosystem develops. This additional incentivisation dissipates smoothly over the 36 months, transitioning to the long term incentive mechanisms inherent in the FTSO, incentive pool, FLR use cases and everything built within the ecosystem.

The graph above shows the token distribution through the FTSO as a percentage of available supply. Whilst the numerical amount distributed in each month is the same, the incentive as a percentage of available supply reduces smoothly over the 36 months.

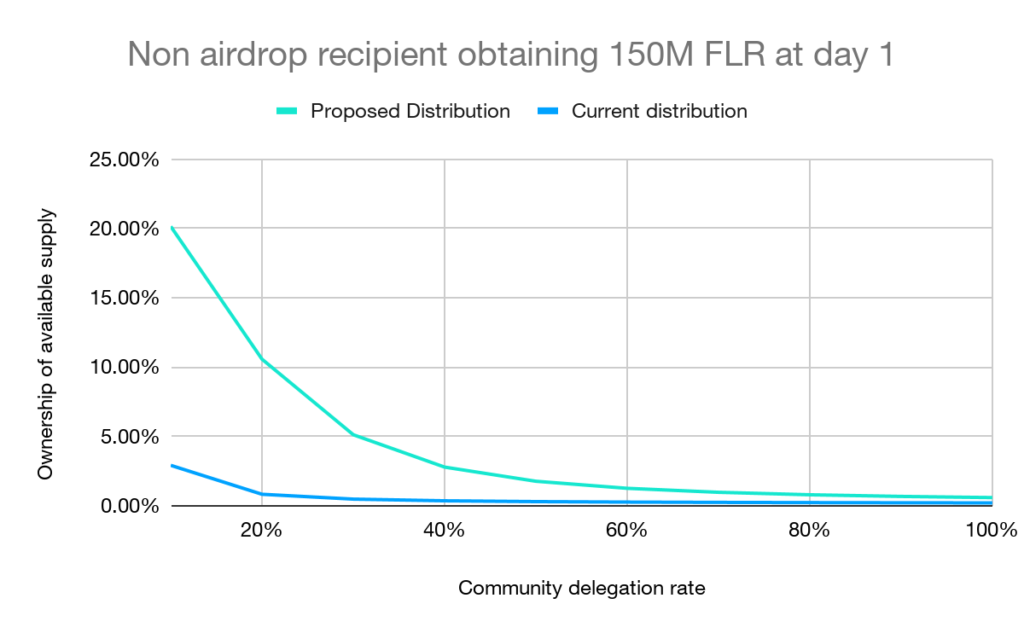

This proposal generates an incentive for wrapping your Flare, reducing supply on the market and substantially reducing excess liquidity relative to the existing distribution scheme. Further, the proposal improves ecosystem development by making ecosystem participation and hence ownership of Flare more rewarding for the non airdrop recipient at every delegation rate, relative to the existing scheme.

The graph above is based on a participant that obtains 150M FLR (1% of initial supply), but is not an airdrop recipient, and delegates 100% of their FLR to the FTSO for the duration of the distribution period. The delegation rate on the x-axis is the community delegation rate as previously detailed.

The blue line shows the result under the current token distribution method and the green line shows the result under the proposed distribution method, at varying delegation rates. Here the reader will notice that the green line in this chart and the blue line in the chart above it are identical. This demonstrates the desirable quality of all token holders being treated equally.

This graph shows that the incentive to hold tokens for non airdrop recipients is substantially higher under the proposal than under the current scheme.

Improve the tokenomics for new ecosystem entrants.

The current scheme was designed for a single community who would broadly all receive some amount of the airdrop and could then decide to participate further should they wish. The current scheme was designed in the context of a single, narrow utility.

Flare has evolved to be much larger in scope than the single utility it was initially designed for. Flare is now designed to be a foundational piece of blockchain infrastructure, and as such, Flare can serve all communities. It can only do this successfully with the participation of those communities. The current distribution scheme creates two classes of participants, those that receive the airdrop and those that do not. As such the current distribution scheme treats some Flare token holders unfairly relative to others. More importantly it treats those that take risk to participate and earn or otherwise acquire the token unfairly relative to initial airdrop recipients. The existing distribution scheme substantially limits the ability of the Flare ecosystem to expand its participant base beyond airdrop token holders and therefore limits the potential for the success of the Flare ecosystem. This is undesirable for existing airdrop recipients and this proposal rectifies this.

This proposal treats all Flare token holders equally going forward regardless of whether they received their tokens during or after the airdrop.

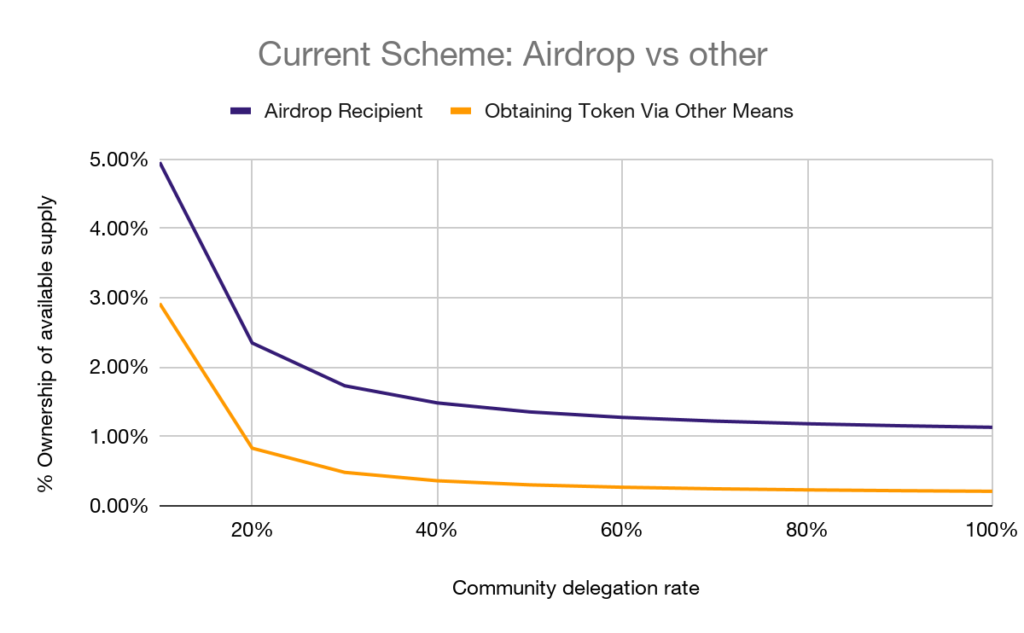

This graph shows the current distribution method, again both participants are starting out with 150M FLR (1% of initial supply) and are again delegating 100% of their tokens throughout the distribution period. The purple line shows an airdrop recipient and the yellow line shows a participant that acquires the token outside of airdrop at inception.

The graph shows that the airdrop recipient ends up with a far greater share of FLR than the person that takes the risk to enter the ecosystem outside of the airdrop. Whilst this was acceptable when Flare was only intended for those from within a single ecosystem (and thus already owned a quantity of FLR from the airdrop), such a distribution method will not appeal to those from outside of that ecosystem.

The current scheme dilutes outside entrants in favor of the airdrop group. The proposed scheme treats all FLR holders equally.

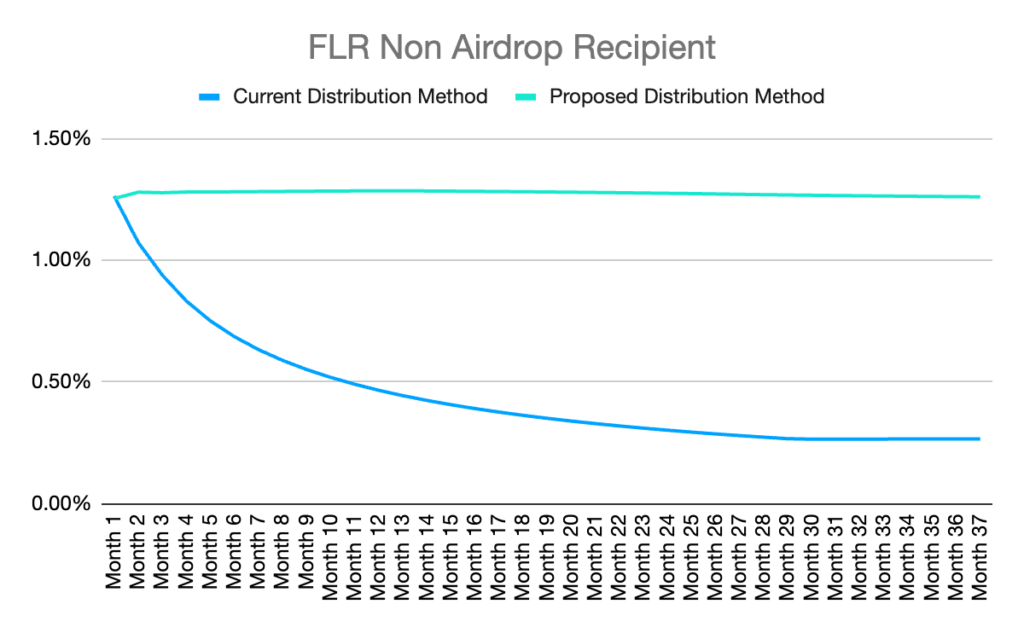

The graph shows the holders’ percentage ownership, over the distribution period, as a percentage of available supply on an assumed purchase of 150M FLR with 100% delegation. The assumed community delegation rate for the calculation is 60%. The green line shows the proposed distribution method and the blue line shows the current distribution method. The current distribution method is diluting the non-airdrop entrant’s ownership percentage month on month due to the airdrop distribution whereas under the proposed distribution the entrant’s ownership percentage is kept constant. Whilst originally feasible for a fixed group originating from a single ecosystem the majority of whom would all receive the token through the airdrop the existing scheme will hold Flare back from being engaged with by the other communities (non-airdrop entrants) that the network has now been built to serve. This is detrimental to existing airdrop recipients and this proposal rectifies this.

Enable the distribution of FLR to be transferable.

Under the current scheme a fixed set of addresses receive the airdrop whereas under the proposal the rights to earn the remaining distribution effectively transfers with the token.

Alleviate the risk of exchanges and CeFi platforms for token holders.

By distributing the airdrop through the FTSO delegation mechanism the risk of an exchange not distributing the further distributions over 30 months is removed.

Reward infrastructure providers and those that generate value for the network by enabling them to vest FLR whilst constraining inflation.

The proposal enables those who earn Flare, either by providing infrastructure such as the FTSOs and validators or by transporting value using Flare’s bridges, to further vest in the ecosystem by deploying their Flare to earn a portion of the distribution. This additionally allows the network to reduce non distribution related inflation which is beneficial for all token holders over the medium to long term.

Enable tax deferment such that those that participate in the ecosystem are not unduly penalized.

The escrow contract enables a participant to park their tokens in FLR and manage their delegations over time but to not receive the rewards from that contract until they pay a network transaction fee to do so. In some jurisdictions this will have the effect of deferring the taxation on the earnings until the date of actual receipt. This is not tax advice, please consult an accountant or tax professional before relying on the escrow contract.

Method

Distribution:

Per month 3 random blocks will be chosen. At each chosen block the amount of wrapped FLR held by each address will be calculated.

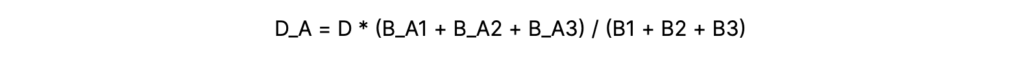

- D_A is the amount of FLR received by the address in a given month.

- D is the total amount of Flare distributed in a given month.

- B_A1 is the amount of WFLR held by the address at random block 1.

- B_A2 is the amount of WFLR held by the address at random block 2.

- B_A3 is the amount of WFLR held by the address at random block 3.

- B1 is the total amount of WFLR held by all addresses at random block 1.

- B2 is the total amount of WFLR held by all addresses at random block 2.

- B3 is the total amount of WFLR held by all addresses at random block 3.

- The definition of a month is 30 days.

Definition of available supply:

![]()

- A_S: Available supply.

- All_tokens: All FLR tokens that exist.

- incentive pool: FLR held in the incentive pool.

- locked_tokens: Tokens locked by the Flare Foundation and associated entities.

- undistributed tokens: Tokens that form part of the public token distribution but which have not yet been distributed.